Despite the negative sentiment, 2022 saw more deal volume than seven of the last ten years. The “high” we experienced from record setting 2021, along with uncommonly high inflation and the doubling of interest rates, brought on “withdrawal” and has crashed us back to down “normal”. The market is percolating though…it’s quite busy, but only a few know about it…and they like it that way.

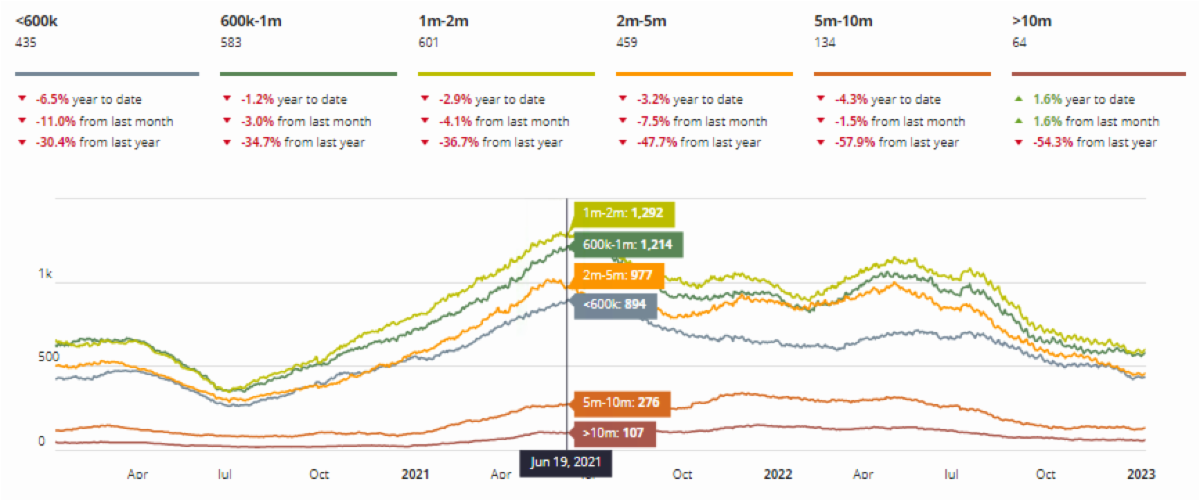

Pending Sales – CLICK CHART TO EXPAND (interactive)

It’s difficult to predict with any certainty what 2023 will have in store, as any range of factors from socio-economic, political, geo-political etc. can influence the trajectory. That said, right now, limited supply and a strong rental market will result in sustained, and even growing, demand on the sale side. Regardless, extraordinary opportunities will present themselves to those with a sound long-term strategy. Don’t try to time the market; it’s a losers game. You will be better served focusing on your own unique circumstances and needs over the long haul. Time in the market typically equals success, but you’ve got to jump in. Those who wait create opportunities for others.

“Success = time in the market, not timing the market.”

For the pessimists, yes, interest rates are higher, but they are not high enough to crush the demand that is already emerging. Those hoping to see 2-3% interest rates, will be waiting a LONG time. Interest rates peaked in mid-November at around 6.5-7% (double what they had been at the beginning of 2022); however, they have begun to moderate to 5.5-6%. This drop and people learning about even lower mortgage options like “adjustable rate mortgages” (ARMs)* have resulted in a substantial spike in mortgage applications, a precursor to a wave of purchases. Buyers are readying themselves, further evidenced by the measurable increase in showings and offers being made, in some cases multiple offers on well-priced properties. Remember, nearly half of all purchasers Manhattan are all-cash; meaning those buyers are far less affected by rates and in contrast actually leverage that fact to their advantage.

* If you need a good mortgage professional, please advise, as I am happy to make recommendations based on your particular circumstances.

Where we are: In the most interest-rate-sensitive price categories (between $1-3M) there were significant drops in deal volume in the second half of 2022. Generally, when transaction volume drops like this (down 20-25% YoY), we would see an abundance of inventory. In this unique circumstance, however, we are seeing compressed inventory. With the selling season approaching, thankfully we’re beginning to see this ease, albeit slowly.

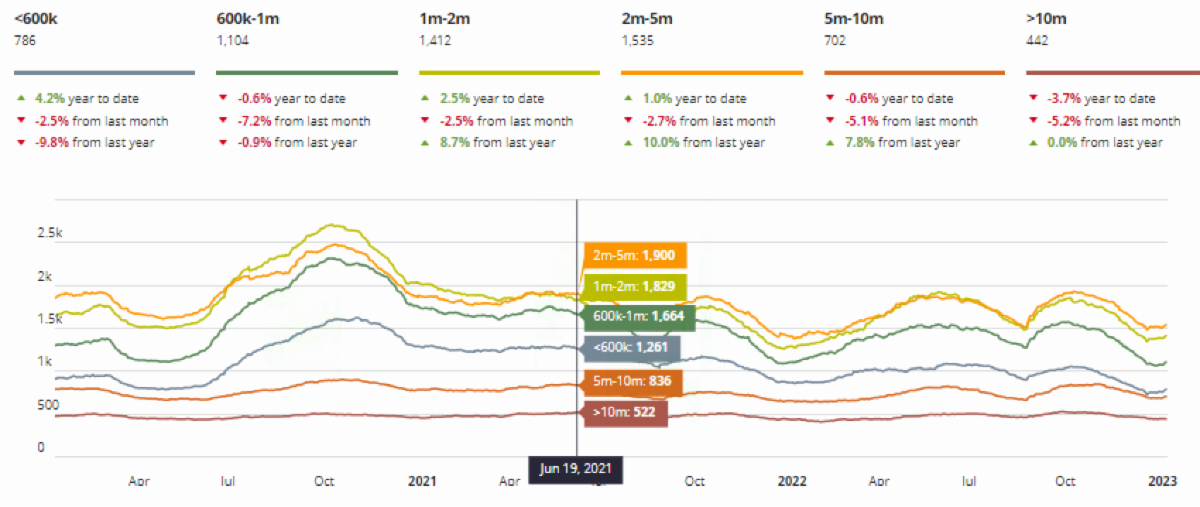

Supply – CLICK CHART TO EXPAND (interactive)

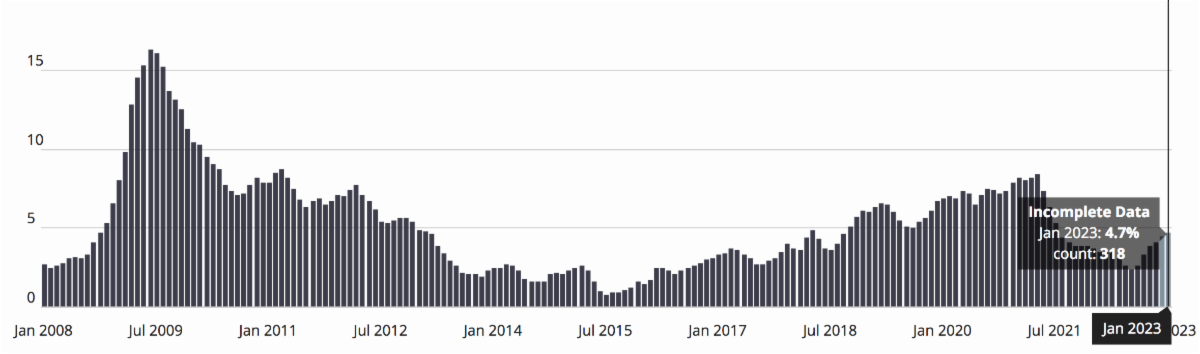

This compression in inventory is primarily a result of sellers not wanting to sell their properties into an environment of low sentiment and languid demand. Many sellers have also been locked-into low interest rates which they’ve been hesitant to relinquish. Further to the compression was the slow-down of new construction over the pandemic. As a consequence though, we are also experiencing price stability, as negotiability hovers healthily around 4-5% across the board, for now. [see chart below]. This is the key; sellers have increasingly recognized the rendezvous point between bid and ask requires negotiability and their expectations increasingly reflect this. The result will be a fair market fueled by growing numbers of transactions and liquidity. This is a good thing.

Median Listing Discount – CLICK CHART TO EXPAND (interactive)

The sentiment among brokers is measured optimism. Although economic growth will be shallow and unemployment will rise a bit, inflation’s peak is likely in our rear view mirror and moderating interest rates will continue to provide much needed certainty. The easing USD$ will also encourage foreigners to engage.

We are in a “moment in time” where many factors are converging to create this buyer’s market, but those factors in sum are also signaling it will be short lived. Your circumstances will be unique and, as you know, I am always around to chat.

As you know, I always say two things: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.